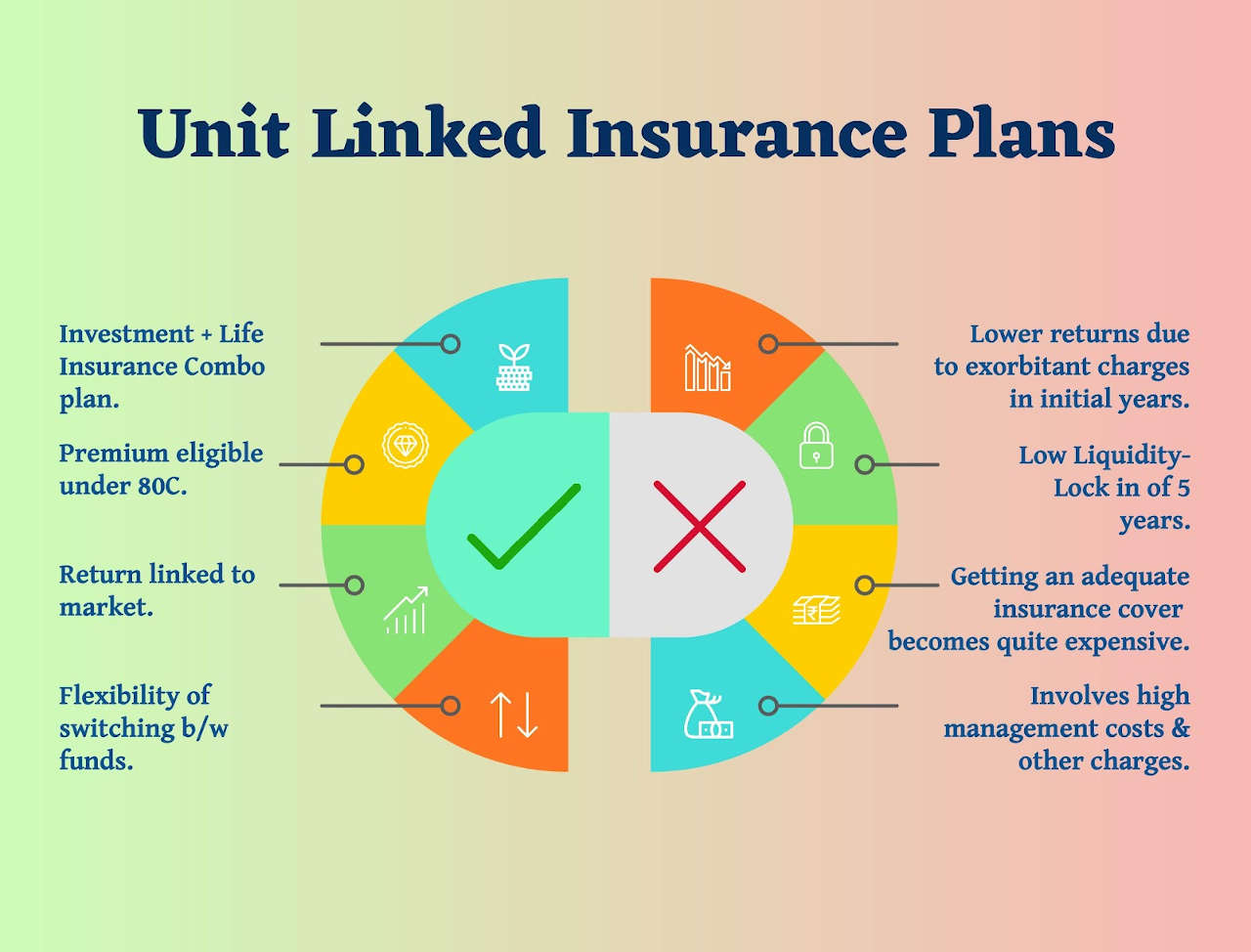

Investment-linked insurance plans, often referred to as unit-linked insurance plans (ULIPs), are life insurance plans which combine protection with investment.

A part of the premium paid by the policy buyer is utilized to provide him life insurance coverage while the remaining part of the premium is invested in financial funds, wherein the investor is allotted units.

Investment-linked plans are exposed to investment risk, like other types of investments, which is borne entirely by the policy buyer.

Such plans charge different types of fees and charges towards insurance coverage, fund management, policy administration, surrender, fund switching, etc.

All such fees and charges are typically deducted through the sale of the units while the rest of the units remain invested in the policy.

Features of Unit Linked Insurance Plan (ULIP):-

PROTECTION, INVESTMENT, AND INCOME TAX BENEFITS (SUBJECT TO LOCK-IN PERIOD)

- While the premium of such plans remains constant throughout the life of the policy, the cost of insurance coverage increases year by year as one gets older. This implies that more units have to be sold to pay for the insurance charges, leaving fewer units for investment under the policy.

- ULIPs do not guarantee cash values. Instead, the fund value of the policy depends on the market price of the units held under the policy at the time of redemption/maturity.

- Another feature of ULIP is that as the financial needs of the investor change over time, he can vary his insurance coverage and the investment mix. He may also top-up his investments, make withdrawals and switch funds.

- ULIPs offer tax benefits both at the time of investment and on the maturity of the policy.

- Premiums paid for ULIPs are eligible for tax deduction under Section 80C of the Income Tax Act, 1961 up to a maximum of Rs.1,50,000/-. However, such plans must be kept in force for a period of 5 years to claim the deduction, and the premiums must be paid regularly to avail of tax benefits.

- Further, under section 10(10D) of the Income Tax Act, if the premium paid on the policy is up to 10% of the sum assured during the entire term of the policy, the amount received on maturity is exempt from tax.